How Fideltour Moved from ARR to MRR

A real story about leaving vanity metrics behind, facing the uncomfortable truth, and building a more resilient SaaS business

For years, we were lying to ourselves

.

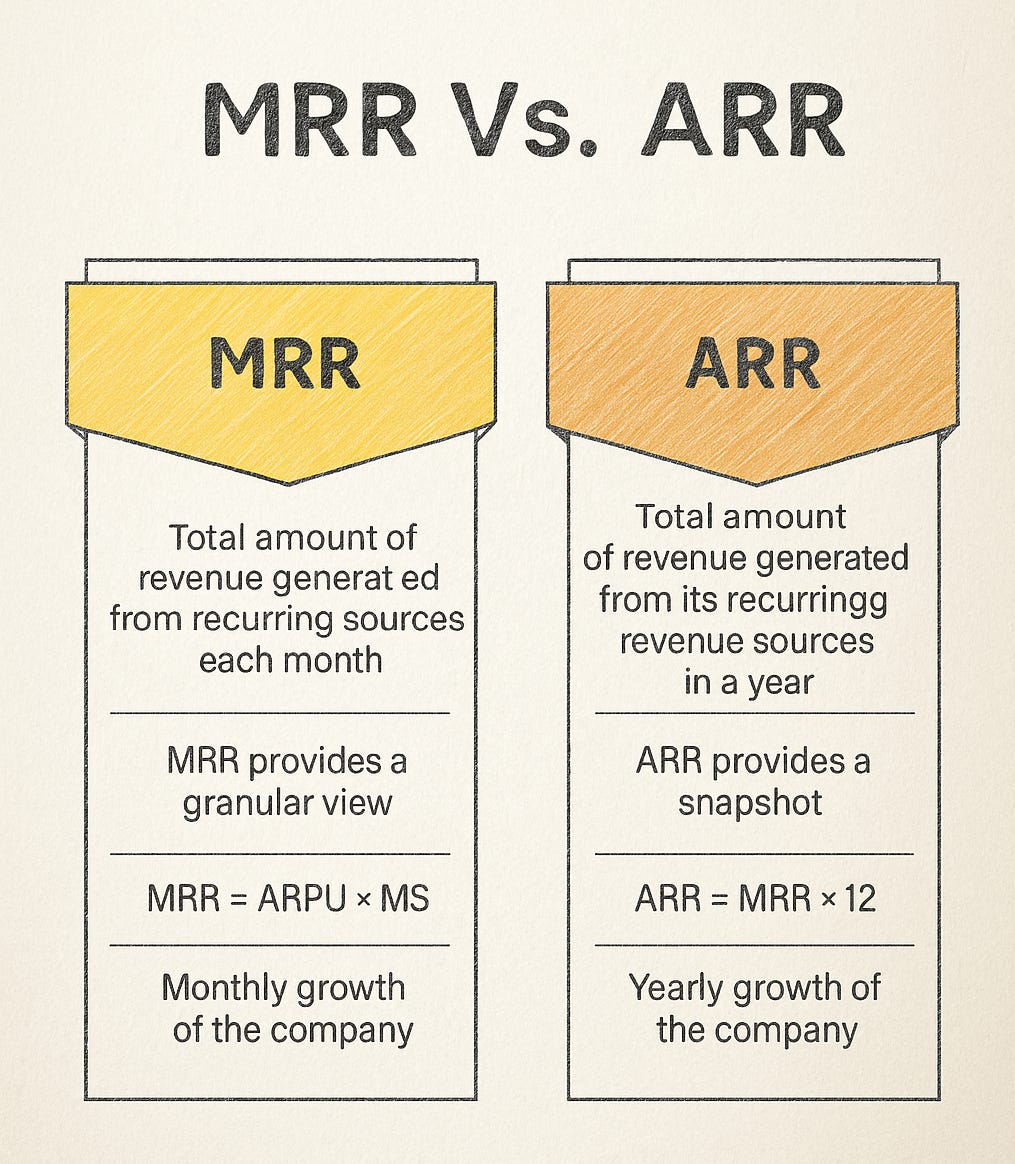

Of course, we didn’t see it that way at the time. Like many SaaS companies, we were obsessed with one magic number: ARR.

The big number. The one that looked great in pitch decks. The one that impressed investors and made us feel like we were on the right track.

But behind that number was something we didn’t want to see.

The illusion of ARR (and the wake-up call)

When we started Fideltour, tracking ARR made total sense.

Why?

Because almost all of our contracts were annual commitments.

Some customers even paid the full year upfront, usually with a discount for early payment.

And of course, ARR was the “shiny badge”—the number that sounded big, bold, and easy to celebrate.

Our team cheered every big contract win like we had won the Champions League.

But as the business started growing and expanding internationally, things began to shift.

More and more customers were asking for monthly payments.

Why? Because it was simply more practical for them.

And, honestly, it became more practical for us too:

Big annual invoices delayed payments because they had to be reviewed, approved, and signed by multiple people.

Monthly payments, on the other hand, were generated automatically and charged on a recurring basis—no bottlenecks, no bureaucracy.

The business model was evolving. But our metrics weren’t.

The turning point: the pandemic

The pandemic was a brutal accelerator. Everything changed overnight, and our internal conversations shifted.

I still remember someone on the team saying in a meeting:

“Why are we celebrating ARR if we don’t even know how many customers will stick around next month?”

That was the moment it clicked:

We needed to track what was happening each month, not just once a year.

We had to understand churn, renewals, upsells.

We couldn’t run a living, breathing business on a frozen metric.

We decided to flip the script. We went all in on MRR.

What changed (and how it transformed us)

The shift wasn’t easy, but it was the best decision we made.

We started having real conversations about churn, upsell, and expansion.

We aligned the entire team—sales, support, product—around the same monthly metrics.

We designed more flexible subscription plans, removing exit barriers.

We improved our forecasts: we went from guessing to knowing, from reacting late to anticipating early.

And critically, by moving to monthly billing cycles, we reduced payment delays and gained financial predictability.

The result? ARR didn’t disappear. It grew. But this time, as a natural outcome of healthy, sustainable MRR.

Why measuring churn properly matters for NRR

Another key lesson was realizing that miscalculating churn wasn’t just dangerous—it distorted our view of the entire business.

Early on, we only tracked ARR, and it looked like we were retaining well.

But once we began tracking MRR, we saw some customers were already halfway out the door, and our Net Revenue Retention (NRR) was lower than we thought.

That shift helped us:

Spot risks before they turned into cancellations.

Strengthen existing accounts with upsells and better service.

Build a business that grows not just through new customers, but because current customers want to stay.

The lesson we learned

Today, when someone asks about our ARR, we know the answer.

But internally, our compass is MRR.

Because what you don’t measure month by month, you can’t improve.

Because a SaaS company doesn’t live on annual promises—it lives on constant relationships.

Because in the end, we want a business where customers stay because they want to, not because they’re locked into a contract.

Final reflection

Switching from ARR to MRR made us a more conscious, agile, and human team.

If you’re building a SaaS business, here’s my question to you:

Which metric helps you sleep better at night—the one that impresses others, or the one that shows you the truth?